Globalization has yielded many economic benefits for modern society, but the COVID-19 Pandemic and the Russian invasion of Ukraine have been a sobering lesson about the vulnerability of that paradigm to supply chain disruptions. While a major pivot towards protectionism would be counter-productive, for some key commodities it would be prudent to enhance domestic supplies. For agriculture it has become clear that over-dependence on imported fertilizer can lead to problematic risk and cost scenarios.

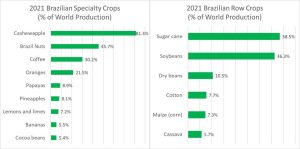

Consider the situation with Brazil. That nation plays a key role in the global food supply because it has the land, water and climate to be highly productive. Brazil must continue it’s role in feeding the world.

Brazil currently relies on imports for 80% of its nitrogen and phosphorus fertilizer and 98% of its potassium or “potash” supply. This was not always the case. Until 2011 there was a substantial supply of potash being mined in-country, but as that resource began to decline it was back-filled with imports. Imports are problematic as around 47% of the global potash supply comes from Russia and Belarus, leaving the rest of the world in a practical and ethical quandary for how to source that critical crop nutrient.

There is a company called Brazil Potash that is developing a domestic supply solution. It’s CEO, Matt Simpson, sees their efforts as an example of “selective globalization” which balances the benefits of economic efficiency with the need to minimize the vulnerability of key industries. It turns out that there are major, untapped deposits of potash in the state of Amazona. Brazil can reduce its dependency on imported potash by tapping undeveloped domestic reserves and that is a win-win for that exporter and its global customers.

The sites were originally controlled and surveyed by the energy giant Petrobras, but they dropped the permits and Brazil Potash then acquired the rights from the government.

The potash is at a depth of 2,400 feet but this new company has done the exploratory drilling, cost and environmental impact assessments to document the feasibility of mines. They have raised the necessary capital and navigated the regulatory process. Their plan is to begin tapping that resource by mid-2023. Mining at 2,400 feet below the ground is certainly challenging, but Brazil Potash is planning on a “room and pillar” system in which two large shafts can convey equipment and crews to that depth. Once the mineral has been brought to the surface, a hot water process is used to dissolve the ore and then crystalize out the desired potassium chloride for fertilizer and separate it from the sodium chloride that is also in the ore (the same sodium chloride that is in table salt but not something you want to put on a crop).

This will be a relatively energy intensive process, but in Brazil 80% of the electricity comes from renewable sources – particularly hydroelectric – and so the fertilizer they will be making will have a significantly lower carbon footprint than that from current sources. There is even another layer of efficiency in that Brazil Potash will be able to transport its products on barges that are on their back-haul trip from taking grain to port for export. This will be happening in the Amazonas region where there are many relatively small towns that are not yet connected to the national electricity grid and so they use diesel generators for power. Because the new mining operation is justifying the investment in transmission lines, these communities will soon have access to much cleaner energy.

![A welcome sign for the small city of Autazes (population ~34,000) which is 12 miles from the new ... [+]PHOTO VIA BRAZIL POTASH](https://brazilpotash.com/wp-content/uploads/2023/02/4-300x215.jpg)

Brazil Potash has raised 240 million dollars for this project, initially from seven key family office and sovereign wealth funds and then from 120 other investors. Later they filed a prospectus with the SEC in the US allowing them to raise an additional funding from seven thousand everyday investors. They have filed 76 of the 78 documents needed to gain regulatory approval to begin the construction of the mine, and expect a rapid review since Brazil has specifically prioritized fertilizer independence at the political level. The above ground “footprint” of the operation is relatively small and within a grassland region, not the Rain Forrest. Within 4 years Brazil Potash anticipates producing 2.2 Million metric tons of fertilizer per year and eventually plans to expand to 12.5 Million. The initial site has enough potash to last for 34 years and there are enough other known deposits for a 300 year supply. This should ensure Brazil’s role in feeding the world well into the future.

Produced by: Forbes