Fertilizer prices have been on the rise for the past few years, but they could cool off by 2023. Prices have risen more than 30% since the start of 2022 alone. This is due to various factors, including input costs, export restrictions, and supply disruptions. If you’re in the agriculture industry, then you need to be aware of these trends and plan accordingly. In this article, we’ll discuss why fertilizer prices have remained high for some time, but could finally cool off by the first half of 2023 thanks to some big changes coming to the industry, including a new project from Brazil Potash.

Potash is one of the key ingredients in fertilizer, and demand for it has been surging in recent years. This is partly due to the fact that potash is used in the production of food crops, like corn and soybeans. With the world population continuing to grow, there is more pressure on farmers to increase production. This has led to increased demand for potash, which has put upward pressure on prices that could abate by 2023

Market Barriers Hold Back Producers

One of the biggest issues is supply and the current disruptions. Countries like Brazil import significant amounts of their fertilizer and potash and want to increase national production. Brazil Potash, a company engaged in the development of a new potash project called the Autazes Potash Project in Brazil, aims to help the country hit those targets.

Brazil is one country that is highly reliant on foreign potash because it imports more than 96% of its needs, with 47% coming from Russia and Belarus, both of which are sanctioned at the moment. This puts Brazilian agriculture at the whim of these international suppliers.

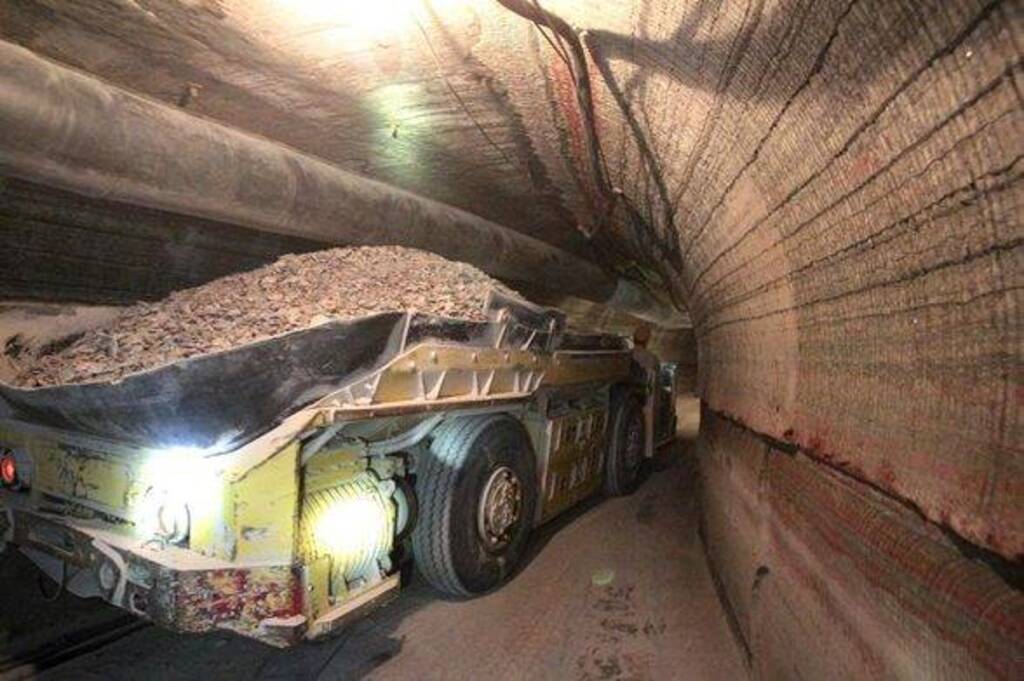

Brazil Potash plans to compete with current market leaders by introducing the Autazes Potash Project, with numerous benefits for the potash market and Brazil. Autazes Potash Project is located in Brazil’s Amazonas state, approximately 20km away from the city of Autazes. It is being developed by Brazil Potash subsidiary Potássio do Brasil Ltda., a fertilizer company. Brazil Potash aims to produce 2.4 million tonnes per annum (Mtpa) of granular potash, which will supply approximately 20% of the Brazilian Agribusiness’ needs. The mine will employ around 1,300 employees initially, primarily from Autazes and the region.

A Project to Compete Sustainably on a Global Scale

The first major advantage of the project is the size of the Amazon potash basin where Brazil Potash’s Autazes project will get its potash supply from. Scientists believe that the Amazon potash basin has great potential to be one of, if not the largest proven sources of this fertilizer. It would compete with basins around the world including those in Canada and Russia which together make up 80% of all global production.

The Autazes Potash Project also has a significant logistic benefit since it will be built on existing agricultural land near the Amazon River System. The Autazes Potash Project will be Brazil’s lowest-cost potash source, changing the industry and country for the better.

The reduction of carbon emissions is extremely important to Brazil Potash and the Autazes Project is set to make a large impact in the fight against climate change. The project will get 85% of its energy from renewable sources. It will also aim to reduce unnecessarily long distances when transporting its produced potash to maximize the efficiency of operations and emissions.

This was further expanded upon in Brazil Potash’s Environmental, Social, and Governance (ESG) report. Backed by the company’s management team and a group of third-party experts, it confirms that the Autazes Potash Project will ultimately be one of the most environmentally clean potash projects in the world. These efforts could result in the project emitting 79% fewer greenhouse gas emissions than current producers.

Pressure to Increase Production Intensifies

Potash is one of the key ingredients in fertilizer, and demand for it has been surging in recent years. This is partly due to the fact that potash is used in the production of food crops like corn and soybeans.

One of the main reasons why fertilizer prices have remained high is because input costs have been rising. Natural gas prices, for example, have been on the rise in recent years. This has led to production cutbacks in ammonia, which is used to produce nitrogen-based fertilizers. These cost increases have been passed on to farmers in the form of higher fertilizer prices.

Another factor that is driving up fertilizer prices is export restrictions. China, one of the world’s largest producers of potash, has been restricting exports in recent years. This has led to supply disruptions and higher prices for potash on the international market.

Finally, sanctions on countries such as Russia and Belarus have also led to disruptions in the fertilizer market. These sanctions have made it difficult for companies in these countries to export their fertilizers.

For some time, exports were blocked in the region and they dropped off precipitously. As blockades have lifted, it has reduced some of the strain on the supply chain. However, risks to the global food supply persist, with many developing nations at risk of food shortages in the coming year and further. The potash market was tight, to begin with, and so all of the challenges the supply chain is facing have made it all the more difficult to maintain stable pricing and supply which should come in the first half of 2023 according to some experts.

The current potash market is disrupting everything from fertilizer production to food prices. Higher fertilizer and potash prices are expected to be here for the long term, so producers will need to find ways to increase efficiency and cut costs. The Autazes Potash Project aims to do both while giving Brazil the project that it needs to change the dynamic of its domestic potash market forever.

Brazil Potash Educates the Next Generation and Introduces the Autazes Potash Project to CETAM

Students in the Technical Surveying Course at the Centro Tecnológico do Amazonas (CETAM) recently had a chance to learn all about the project, when the company presented at the school. The centre teaches professionals in mapping, which is essential to engineering projects. This was an excellent opportunity for students to learn more about the project, a key potash operation in Brazil that is presently undergoing the licensing process.

Students at CETAM listen to the presentation from Brazil Potash.

Students at CETAM listen to the presentation from Brazil Potash.

The director of ESG at Brazil Potash, Lúcio Rabelo, said the presentation highlighted the impact of the Autazes Potash Project on society, the economy, and the environment to students. When students participate in the project, they will have an opportunity to apply what they’ve learnt during CETAM. Lucio Rabelo commented: “These are young people who are graduating, receiving a qualification, who will have the opportunity to apply the knowledge they are receiving. They verified that, indeed, many opportunities will arise to help, in the great project that is being implemented here, so that the municipality can develop.”

Brazil Potash’s new project could help change the potash landscape and provide a lower-cost option for Brazil and other countries that are highly dependent on imported potash. Fertilizer and potash prices will likely squeeze higher in the near term, creating issues for many importers and buyers, but the Autazes Potash Project aims to upend all of that and establish a new, more sustainable potash market for Brazil.

Produced by: Hedge Think